An appraisal is a technical study that determines the true value of an asset, such as real estate, machinery, or equipment. It is used to support key decisions in processes like property transactions, mortgage loans, insurance, legal proceedings, taxation, and investment planning. At ARAICA, we provide accurate and reliable appraisals backed by specialized technology.

- What is an appraisal used for?

An appraisal is used to determine the true value of an asset—such as real estate, machinery, or equipment—in order to make informed decisions in a wide range of situations. For example:

- In property sales, it helps set a fair market price.

- In mortgage loans, it ensures the loan is backed by the asset’s real value.

- In insurance, it establishes adequate coverage in case of loss.

Additionally, appraisals are essential in resolving legal disputes (inheritance or litigation), determining property taxes, and supporting investment planning.

- How can I request an appraisal?

Step 1: Request a quote

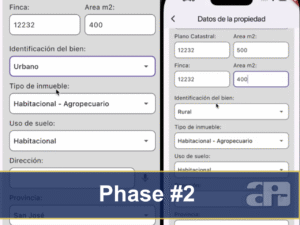

Contact us via our form or WhatsApp (+506 6250 6029). To prepare your quote, we’ll need:

- Property number or plan number

- Indication of whether the property has buildings, and their type

With this information, we will send you a quote within 24 hours.

Step 2: Schedule the inspection

Once the quote is approved, we will coordinate the visit with your designated contact person.

Step 3: Receive the report

We are committed to delivering the final report within one week of the inspection, available in Spanish and/or English.

Need it urgently? Contact us!

- How often should appraisal be done?

We recommend having an appraisal at least once a year, as real estate markets and economic conditions fluctuate and can significantly affect property values.

Our reports are valid for one year as standard. However, in specific cases—such as financing, insurance, or legal procedures—some institutions may require a more recent appraisal.